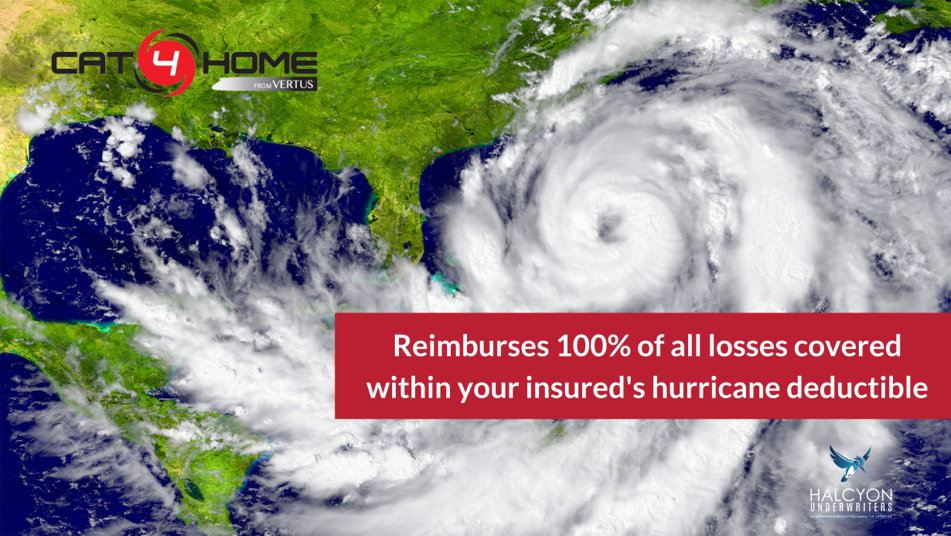

Cat4Home Policy Coverages

A simplified description of the Cat4Home coverages is that it “reimburses the insured for losses in the policyholder’s named storm or hurricane deductible within their primary homeowner’s, condominium unit owner’s or dwelling fire policy.” This enhanced hurricane coverage is a follow-form policy identified in the overlying policy and the hurricane deductible yearly, with an aggregate limit. Moreover, there are two products within this program with flexible limits. The Core Product offers limits from $2,000 – $20,000 for homes up to $1 million in structural value. The second product is the High-Value Home Product, offering limits above $20,000 to $100,000 for homes up to $5 million in structural value.

Premiums are formulated based on county, home and roof age, distance to the coast, and type of construction. Insureds are eligible for this enhanced coverage if their primary policy is in one of the following states: Florida, North Carolina, South Carolina, Virginia, Mississippi, Alabama, and Texas. The insurance company is A+ A.M. Best rated offered as a non-admitted product. [1]

Benefits of Cat4Home Hurricane Deductible

If an insured with a Cat4Home policy endures a loss due to a named hurricane (Category 1 or higher) as announced by NOAA or NWS recognized by the state, then their Cat4Home policy pays for their hurricane deductible.

For instance, if there is a 2% deductible on an insured’s $750,000 home, that equates to $15,000! Without Cat4Home, the insured must pay the deductible up front before the carrier settles the claim. This expense can be unexpected for homeowners.

Cat4Home policyholders that experience a loss from a hurricane have their Cat4Home policy pay for their hurricane deductible and can reduce total out-of-pocket expenses down to $0! Another benefit from this program is the timely payment of claims to help the insured recuperate and restore their home in ample time. Also, Vertus offers this reliable coverage with annual premiums as low as $220, deductibles range from $1,000 to $100,000, and Cat4Home has a superior A+ rating with A.M. Best.

These benefits provide a magnificent opportunity for your insureds to become aware of their deductible and have a plan to pay it with Cat4Home. It is wise to expect the unexpected when it comes to the safety of your insured’s homes and savings.

How To Get a Quote?

Get a quote today by sending in your submission to our Personal Lines team at [email protected].

What is required in your submissions to receive the best quote? Before sending in your submissions, please be sure to include the following information:

- Year built

- Floor area [in sq. ft.]

- Construction type [masonry or frame]

- Address with zip code

- Primary policy Coverage A limit

- Roof age

- Roof material – asphalt shingle, clay tile etc.

- Screened enclosure [Y/N], Carport [Y/N], Fence [Y/N]

- Prior claims

- Any wind mitigation completed on the home and documented

Primary and secondary homes, rental properties, and investment properties are eligible for a Cat4Home policy. For the most accurate quote, it is highly encouraged to provide any documented wind mitigation.

In conclusion, Cat4Home offers an undeniable opportunity for homeowners. By reducing the insured’s out-of-pocket expenses with this follow-form, your insureds have a clear conscience in the event of a hurricane. With the broad deductible range and their reputation, the Cat4Home product is an appropriate option. For any additional questions, please reach out to our Personal Lines Leader, Sarah Cadle, at [email protected] to start protecting your homeowners and their savings with Cat4Home by Vertus.

Sources:

[1] http://www.vertusinspartners.com/florida-hurricane-insurance-products/

This content is strictly informational and should not be used as specific advice on insurance products, legal, accounting, and/or tax related matters. Insureds should always contact the appropriate licensed professional for their insurance, legal, accounting, or tax needs.